Customer Lifetime Value: All you need to know about it.

Written by Edoardo Dal Negro, Co-Founder at Blinkup & Virginie Rouault, Manager Sales Europe at citizenM

Edited by Laurie Pumper, Communication Director, HEDNA

A growing number of companies maximize investments aimed at retaining customers for as long as possible. In fact, it is much cheaper to market to a loyal customer than to new customers. With that in mind, it is important to understand your Customer Lifetime Value (CLV).

The complexity of the distribution ecosystem within the Travel/Hospitality industry requires companies to use different approaches to calculate the total revenue generated.

It is crucial to analyze the relationship between the cost and the investments on direct channels versus other sources. Indicators to consider are revenue, room nights and other KPIs. It is important to check this financial ratio versus the Online Travel Agents (OTA) costs. On a monthly basis, this analysis is then compared to the CLV model to drive better decision making.

Assumptions

Within the hospitality industry, the “competitors” to consider are:

- hotels in specific destinations (including Airbnb, Booking.com, etc.)

- intermediaries like new online travel agents (OTAs) and private sales travel agents

- Users become loyalty members only if they understand the real benefits. They want to be part of a special community instead of getting simple discounts.

- OTAs challenge hotel chain loyalty programs

Customer Lifetime Value Modeling Aim

The goal of the Customer Lifetime Value model is to understand the value generated by specific user cluster. This allows a comparison between web levers or channels. The goal is to have the proper costs associated to a single customer. The costs include the Cost Per Sales and Revenue expected. These costs related to a specific period and to a specific product.

Things to keep in mind

- Every user cluster must be represented on a Cohort chart to create visual impact about frequency rate, order value vs previous months/years, etc.

- Identify the right customer clusters that maximize the investment on a CLV basis. Do not use a first overview where the revenue comes from one-shot marketing actions.

- Determine a model that will allow you to cluster guests into groups based on their behavior patterns (new, loyalist, lost, sleeping, winners). You must define criteria to be used in your formula such as:

- Frequency (number of stays per year)

- Monetary value

- Preferred booking channel

- Destinations

- For corporate customers (companies), determine a segmentation (new, nurturing, maintenance, key and strategic type of accounts) to allocate your team efforts while moving accounts towards a higher CLV.

Benefits

The measurement of Customer Lifetime Value provides many benefits; among them are:

- The real potential for each web lever (e.g. initiator, contributor, converter) to generate revenue during the customer lifetime or another time period.

- Cost per acquisition is merged with the real capability from that specific user/cluster to generate revenue during the life or period. The break-even will define whether timing is temporary, medium, or long term, and is not related to one single action.

- The financial analysis of cost vs the hotel’s pickup and the CLV allow you to apply corrective changes to the Room On The Book, to limit/reduce the cost applied to the top line, thereby maximizing the bottom line results.

- The new data will highlight:

- The role that each direct web lever can drive; for example, direct revenue with minimum impact (Metasearch) but with low increase of new customer – lifetime additional revenue (book directly as a commodity).

- The role of direct web levers that contribute to the CLV, but not in immediate sales. For example, you may see a high cost per acquisition vs revenue generated with a first booking — but the real potential of that user may not be seen until later (so calculate break-even on an annual basis).

- The strategy related to actions with the OTAs could be one of the most important sources for new (incremental) customers. Linked to this is the cost of the loyalty program for the OTAs’ customers. In the CLV budget estimate, this cost will be higher than the normal direct channels.

The ultimate goal of your segmentation — whether it is from a B2B (guest) or B2C (corporate client) perspective — is hyper-personalization through tailored communication to optimize the customer experience and further grow engagement with your brand. No more uniform communication. Optimize and personalize communication with each segment within your CLV model. Move from 1-to-1 to 1-to-many, further increasing the CLV and customer engagement with your brand.

Personalization allows you to engage customers for the long-run. Winners can become influencers and advocates of your brand. You can engage them in your future product development, giving them access as first users/testers or gathering feedback for your go-to-market strategy.

What’s Next, Once You Know the Customer Lifetime Value?

Congratulations if you already have calculated your Customer Lifetime Value. This is half the battle. The next step is to use the data you have.

Examples of how to use the Customer Lifetime Value:

- Use advanced data analysis to apply dynamic modeling on the traffic acquisition with external elements that could impact the revenue contribution (e.g., based on the ROB).

- Change the annual forecast approach and involve all commercial departments to schedule specific actions in advance to increase retention.

- Consider the external dynamic data source as one of the boost elements for your campaign (e.g., flight discount for a specific destination could increase searches and interest; “just in time actions” linked to those initiatives allow you to jump on large volumes of data). Because the mission is to have new customers that will begin the CLV modelling, you can adapt your bidding strategy and efforts if the cost is higher than your campaign average. The different approach of the CLV model will allow you to cover those costs in the next customer relationship activities.

It Is Not All Positive

- Not all CLV calculations use the same methodology. It is important to use solutions that allow you to compare the CLV model from different sources.

- Cohort analysis on Google Analytics is impacted by cookies policies, cancellation, etc. It’s better to use as much data as possible from logged-in customers rather than pure GA analysis.

- At the beginning, the new CLV approach will probably show higher cost per acquisition vs the initial benefits, so companies must analyze results on a medium-to-long term to completely benefit from this approach.

- Limited knowledge about CLV and old models applied to the hotel contribution analysis encourage companies to continue in the same way. Many companies don’t yet properly understand this important new approach.

- Brand first mentality! Most hotel chains operate on a franchise model, making it very complicated to implement a single system, centralized CLV model and data analytics.

Overall, there are great benefits to understanding the customer lifetime value, tracking it, calculating it and utilizing it to optimize action in your business. Adopting the Customer Lifetime Value metric will allow you to change a business model to push different products or impact strongly on a P&L analysis for medium-to-long term investments. It might even start a new business model, like a subscription.

The cost to implement software, data analytics and AI applied to the CLV will become cheaper in the near future. This will allow Customer Lifetime Value models to be used by more and more companies, from the biggest to the smallest.

You need to collect data to invest in the appropriate systems (PMS, CRM, etc.) that will allow you to gather and store detailed information about your guests’ activities, preferences and booking patterns.

Example Case Scenario

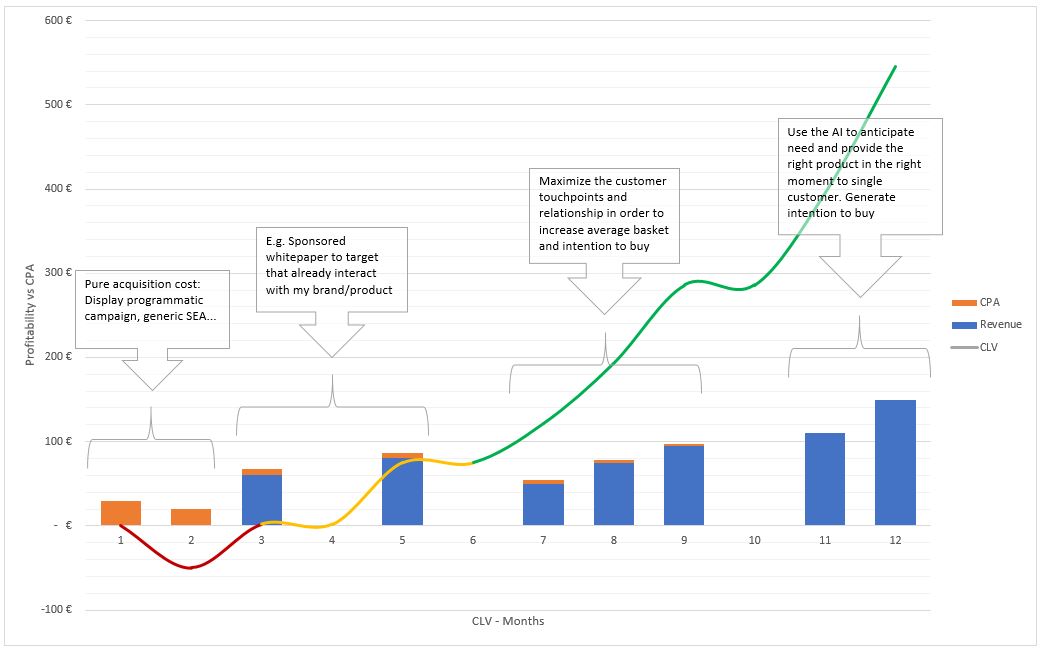

Company “xy” wants to increase awareness through programmatic and SEA generic campaigns, and address messages to one specific target. The campaign starts in January 2019. Mr. James showed interest in the products, clicking several times on ads without completing the acquisition process. During the e-commerce paths, company xy collected customer data and controlled the cost plus the lifetime value for each customer. The total cost for the two months was 50€ vs total incoming of 0€: CLV = -50€.

Between March and May, the marketing department planned a dedicated retargeting campaign on all web levers to drive messages to recent users. Mr. James bought a whitepaper, and in May purchased a new product. Total YTD cost: 65€ and Revenue for 140€, CLV: 75€.

Between July and September, the marketing department gathered more precise data on Mr. James. They released different product information and new services to increase the average purchase. The cost was lower than before (thanks to one-to-one customized advertising), and total customer spending increased . By the end of the year, the use of Artificial Intelligence, in addition to the right product and communication to Mr. James, allow the company to anticipate needs and customer behaviours. YTD 12/2019 → Revenue: 620€ | Cost: 75 | CLV: 546€

Here is an illustration of this example

Figure 1: Example Case Scenario: Customer Lifetime Value

HEDNA Hotel Analytics Working Group

The Hotel Analytics Working Group raises awareness of the opportunities data analysis brings to optimize cost and conversion and thereby empower hoteliers to collect, store, analyze and action their data to make intelligent decisions about their distribution strategies. The group is currently Co-chaired by Matthew Goulden, OTA Insight, and Connie Marianacci, Accor. Click here to find out more and how to join as a HEDNA member.